Strategies, tips, & tools to adapt to the changing real estate investing environment & prosper in the months and years ahead.

We will be updating this page frequently over the next few weeks, so stay tuned.

Most recent expert interviews

Most recent posts

How to turn a $310 negative cash flow property to a positive $2400 per month using this one strategy

How to turn a negative cash flow property to a positive cash flow in the midst of a rising rates environment ? Has your mortgage

Adapt and Thrive Tips: What is the trigger rate and how to manage it?

https://www.youtube.com/watch?v=31uHeIo5eGA If you are in a variable rate mortgage product today where the payment has been fixed and stable during the rising rate environment that

Quick tip: Some context please

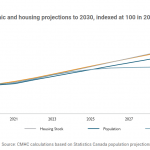

While prices may soften in the short term keep these important points in mind: We still need plenty of immigration to keep the economy strong

Long term Perspective

With interest rates on the rise since early 2022, we have noticed an increasing level of fear, doubt, worry, and concern in the marketplace. Unfortunately

BoC rate hike was extreme, however DON’T PANIC, we have a few suggestions!

I am sure you have all heard of the BoC announcement today!… No one saw those extra 25 basis points coming, but of course, it’s

Social Media

Subscribe and Join Our Community For More Updates!

Tips to manage your cashflow

Tip #1: Don’t let the fear and the noise surrounding us these days make you rush into locking a 5 year fixed rate mortgage.

As you may have heard us say many times, variable rates mortgages have a lot of advantages for investors. Variable rate mortgages are usually much

Tip #2: Consider switching to a capped variable rate.

A few lenders on the street offer a capped variable rate option. Under that option, as the prime rate that impacts variable rate rises, your

Tip #3: Extend the amortization of the mortgage or a loan.

If you have two loans of the same amount—one at a lower rate but shorter amortization and the other at a higher rate but longer

Tip #4: Replace expensive debt with cheaper debt.

Although the rates are rising, the cost of secured debts such as mortgages and lines of credit remains relatively cheap within the bigger scheme of

Tip #5: Convert a portion of a mortgage to an interest-only payment.

An interest-only payment on a loan is often lower than an interest and principal payment. If you want to ease up the impacts of rising

Tip #6: Take a short and long mortgage.

You do not have to choose between fixed or variable. You can choose both! Advanceable mortgages allow you to slice and dice a mortgage into